If you’ve ever hit the jackpot betting on a game or just got lucky on an online sportsbook, you might have wondered: “Do I have to pay taxes on gambling winnings?” The answer depends on where you live and how much you win.

Read on to learn more about how taxes work so you can enjoy your winnings without any surprises.

General Overview of Gambling Taxes: Are Gambling Winnings Taxable?

Gambling winnings are often taxed as income. Whether it’s lottery tickets, poker, or sports betting, your gains might be taxable. I learned this firsthand after winning $500 on a football parlay and needing to check the tax rules. The winnings tax depends on your country and whether you’re a recreational or professional gambler.

A lot of this boils down to how governments view gambling: Is it a hobby, or is it your job? This distinction can make a world of difference, especially when figuring out how much tax you pay on winnings, the sports gambling tax rate in your area, and your tax obligations as a bettor.

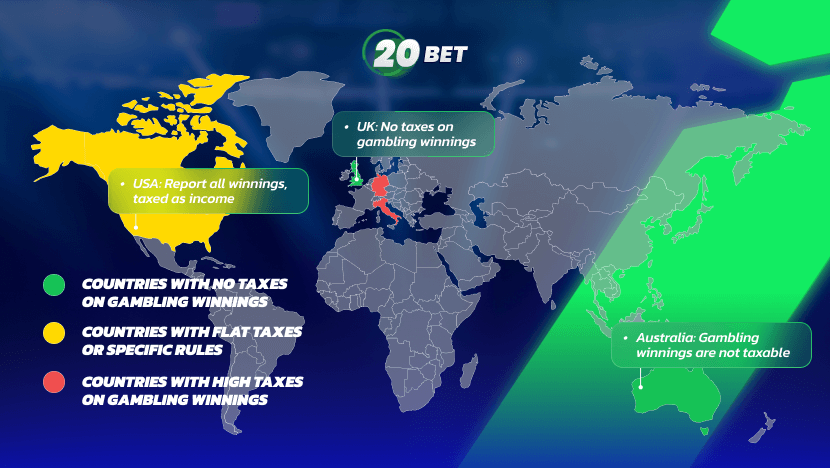

How Gambling Winnings Are Typically Taxed Worldwide

Around the world, gambling taxes are as diverse as the sports people bet on. In some places, you won’t pay a dime; in others, you’ll owe a hefty percentage of your betting winnings. The key factors include:

- Your residency: Where you live often dictates the tax rules you follow.

- The type of gambling: Lottery, sports betting, and casino wins, can be treated differently.

- The amount won: Big wins often trigger more scrutiny.

The Difference Between Professional and Recreational Gamblers

If you’re a casual bettor, like placing a few $20 wagers during the NFL season, you’re likely considered a recreational gambler. In contrast, if you’re analysing stats daily and relying on them for income, you might be classified as a professional. Tax authorities, especially in the USA, have stricter rules for pros.

Taxes on Sports Gambling Winnings in Canada

Good news for Canadians: most sportsbook winnings aren’t taxable since gambling is seen as a game of chance. But if you’re betting like a pro, the CRA might come after your earnings. I’d suggest talking to a tax professional to handle your winnings declaration and stay on the right side of the rules.

Taxes on Sports Gambling Winnings in the USA

In the U.S., Uncle Sam doesn’t mess around with gambling income. All winnings from sportsbooks, casinos, or even online sports betting are taxable. The IRS wants every penny reported, even if you only won $5.

For requirements, here’s the deal:

- Federal taxes take a flat 24% from big payouts.

- State taxes depend on where you live. Some states skip taxing, while others don’t. Check out sports betting taxes by state to stay ahead.

- Sportsbooks do handle IRS reporting, especially for big wins, so make sure you’re filing correctly.

Taxes on Sports Gambling Winnings in Europe

Sportsbook taxation in Europe varies a lot. In the UK, gambling winnings are tax-free (lucky Brits!). But in Germany, when I bet on a soccer match and won €200, I had to declare it as income and pay a wagering tax. Always check local rules before you celebrate.

Taxes on Sports Gambling Winnings in South Africa

In South Africa, if you’re a pro gambler, your winnings are taxed. But if you’re just betting for fun, you’re likely off the hook. It is, however, still a smart move to track your wins and losses. It’s better to be safe than sorry, right?

Penalties for Not Reporting Gambling Winnings in Different Regions

Missing reports can mean severe penalties. Here’s how:

Tax Penalties and Fines in the USA

Not reporting your gambling winnings can mean fines, extra taxes, or even legal trouble. And trust me, the IRS is watching, especially since sportsbooks already report your winnings.

Consequences of Non-Compliance in Canada

Canada is easy on recreational gamblers, but if pros skip taxes, they risk penalties, interest, and audits. It’s just not worth it to hide your winnings.

Tax Evasion Penalties in Europe

In strict tax countries like Spain or Germany, not filing can mean fines or criminal charges. Always file the proper declaration to stay safe.

South Africa’s Tax Laws and Gambling Non-Compliance

South Africa’s tax authority, SARS, doesn’t mess around. Not declaring your winnings can lead to significant penalties. Be upfront about your gains.

Tips for Managing and Reporting Sports Gambling Winnings

Keeping Gambling Records of Wins and Losses

Keep a detailed record of your gambling activity. It doesn’t have to be fancy: a simple spreadsheet noting your bets, wins, and losses works. Trust me, having accurate win/loss statements can save you a lot of hassle if you’re ever audited.

Using a Tax Professional to File Your Gambling Winnings

If you’re unsure about how to handle your gambling taxes, hire a professional. They’ll help you navigate the rules and ensure you’re compliant. Using a sports betting tax calculator can also simplify the process.

How to Avoid Common Reporting Mistakes

Make sure to double-check your numbers and report all your taxable wins, even the small ones. They all add up! Knowing when to report sports gambling winnings is key to staying on track. And hey, if you’ve overpaid, you could often get a refund after filing.

Final Thoughts

Gambling should be fun, but taxes are serious. If you keep track of your payments and income tax obligations, you can avoid penalties and keep your winnings free of stress.

Disclaimer: The content provided on this page, including all predictions, odds, and related information, is for entertainment and informational purposes only. While we strive to ensure accuracy and timeliness, we do not guarantee the correctness or reliability of any predictions, data, or information presented here.

FAQs

Do I Have to Pay Taxes on Small Wins?